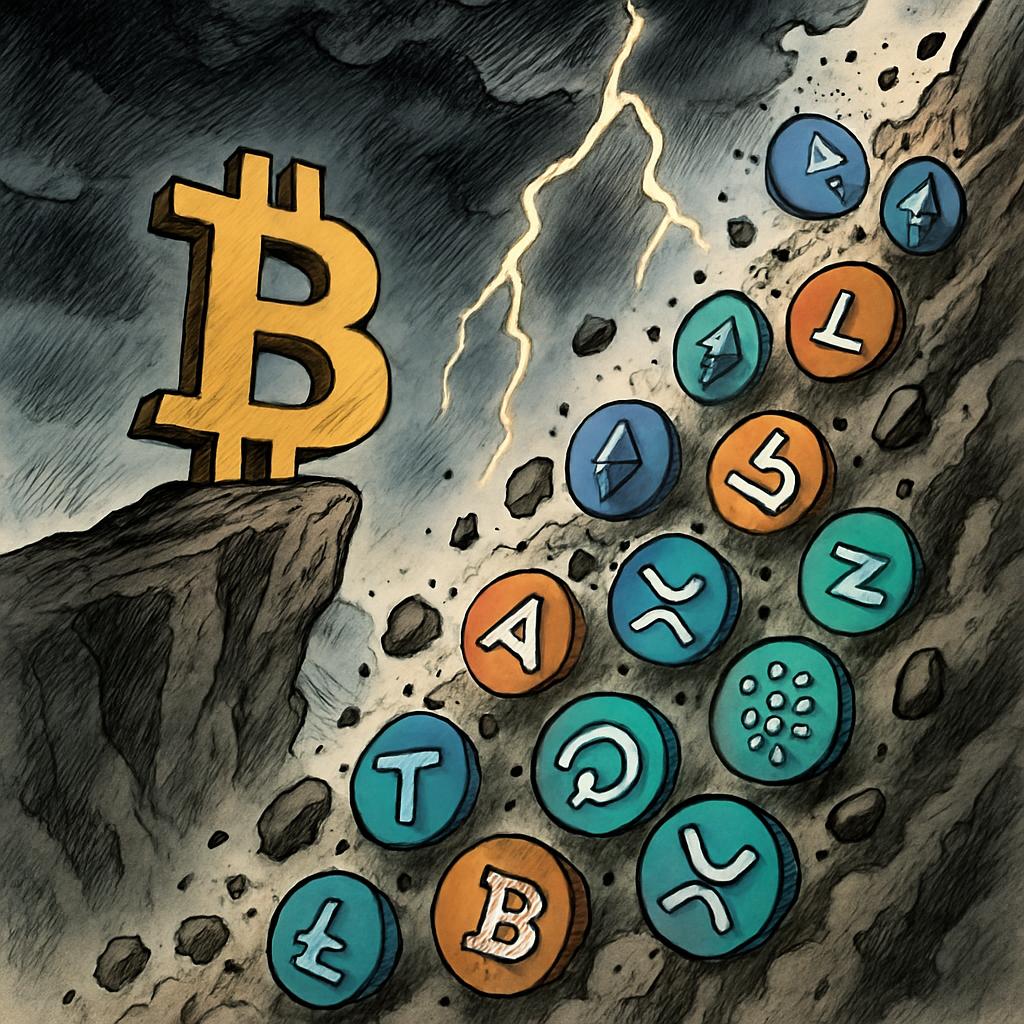

Friday’s crypto sell-off was a fast, leverage-driven cascade that crushed altcoins while bitcoin held up comparatively better, according to Wiston Capital Founder Charlie Erith. The next phase hinges on a handful of key signals.

In a Sunday post titled “Crypto Crumble,” Erith said the market excluding bitcoin, ether and stablecoins fell about 33% in roughly 25 minutes on October 10 before bouncing to a loss of around 10.6%. About $560 billion, or 13.1%, has been erased from total crypto market value since October 6, with $18.7 billion in liquidations during the episode.

He linked the immediate trigger to President Donald Trump’s Truth Social threat of an additional 100% tariff on Chinese imports, but argued the slide was already in motion. Equities were still climbing while crypto “felt distinctly frail,” a divergence he took as advance warning. Bitcoin “behaved largely as expected,” falling less than other tokens and leaving it near a long-running uptrend from late 2022 while boosting its market share as non-bitcoin tokens absorbed “immense technical damage.”

Erith is tracking bitcoin’s 365-day exponential moving average as a line that separates bullish from corrective regimes. A pullback toward the $100,000 area and a touch of that average would not overturn his longer-term view provided the level holds, but a sustained break would raise the risk of a deeper reset.

Автор

- Web |

- More Posts(278)